Municipal Tax Ratio Policy

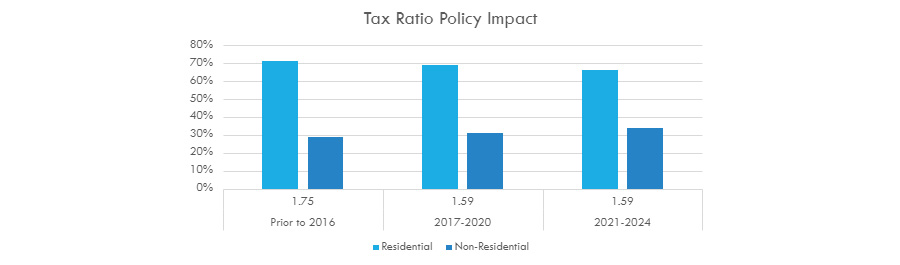

City Council approved a tax ratio of 1.59 on March 22, 2021.

The City’s annual budget determines how much it will need to raise from property owners to pay for civic services such as police, fire protection, road maintenance, transit, parks, recreation and snow and ice management.

The tax ratio policy determines how the tax revenue needed to cover those costs are split between residential and non-residential property owners.

The approved ratio of 1.59 means that for every $1.00 in property tax that a residential property pays, a non-residential property will pay $1.59 on an equivalent assessment.

Administrative Reports

Administrative Report - 2017 Municipal Tax Ratio Policy

Administrative Report - 2021 Municipal Tax Ratio Policy

Appendix 1 - Peripheral Issues Relating to Local Tax Policy 2021

Appendix 2 - Discussion Paper - Business Property Taxation by Cities, What We Know, What We Don't Know, & What We Should 2021

Related Documents /Financing Growth Study-Hemson Report